The Road to OZ Passes Through Colorado

Tax Windfall, Opportunity Zones and Real Estate Investment

By Cameron A. Grant on January 26, 2020

Opportunity Zones, the buzz words of the real estate industry of late, are on the minds of many. If you are involved in real estate and have not heard of Opportunity Zones, it is time to get up to speed. The buzz began with the addition of two sections to the Internal Revenue Code of 1986 (the “Code”), as part of the 2017 Tax Reform Bill. The Treasury Department spent the better part of the past two years crafting the Final Regulations on the Opportunity Zone program.

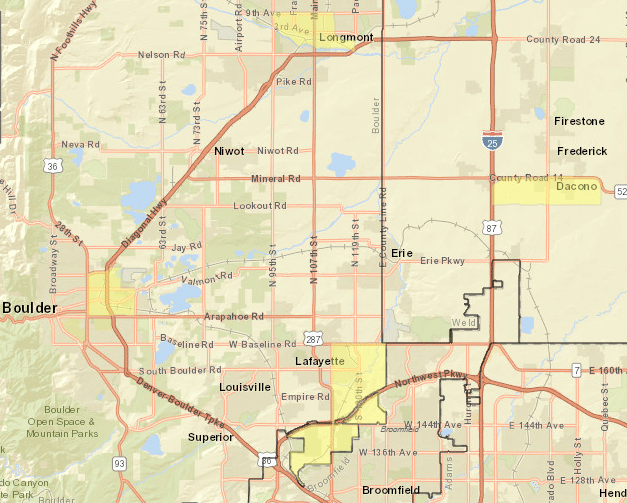

The Tax Reform Bill created more than 8,000 tax-advantaged “opportunity zones.” In Colorado, these range from northern Denver to 28th to Pearl St. in Boulder to most of central Longmont and to all of Bent County. Back in 2018, “Treasury Secretary Steven Mnuchin predicted the zones will attract over $100 billion in private capital” see the Wall Street Journal. You can get a closer look at the Colorado Opportunity Zones here.

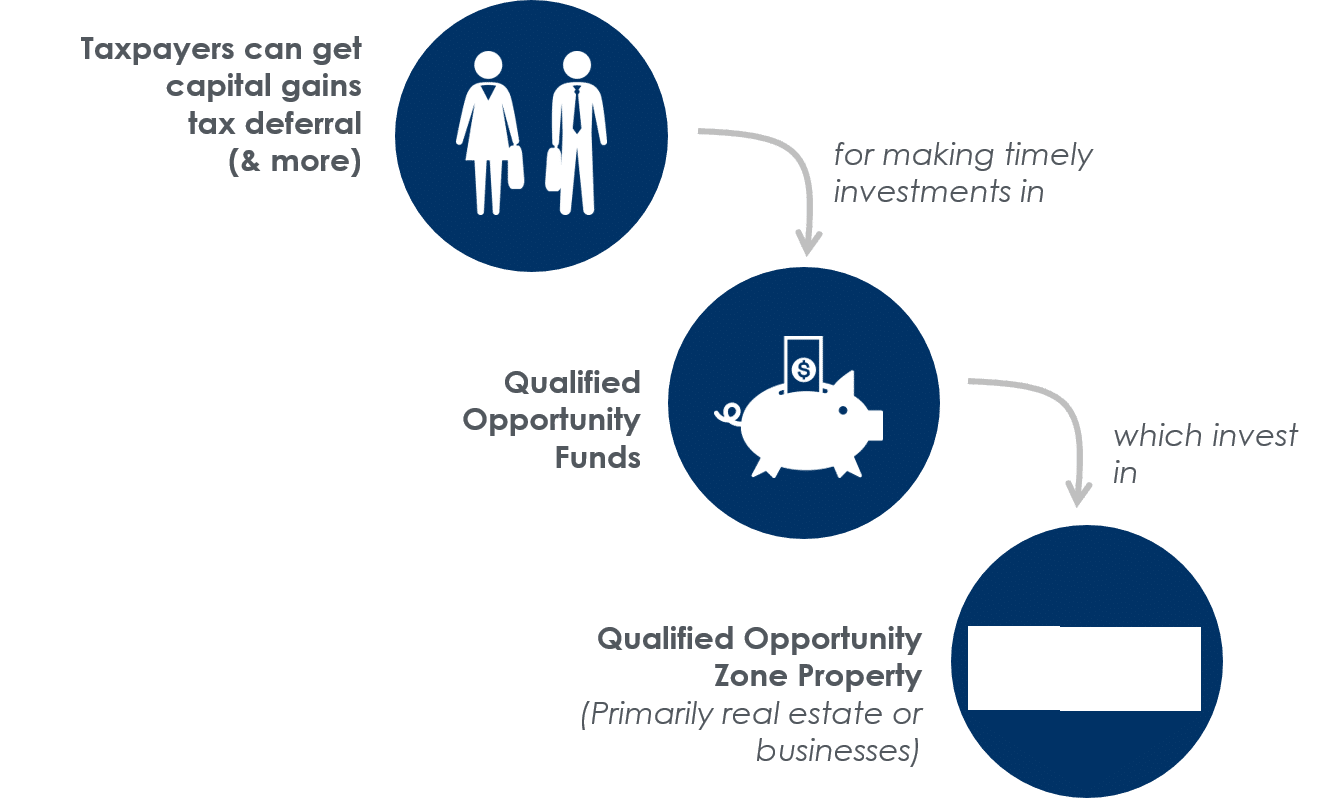

OZone Benefits

Bruce Stachefeld, the Real Estate Philosopher ®, suggests that you think of this “Like a 1031 on Steroids” and tells us that there is a “good” benefit, a “great” benefit, and an “off-the-charts-benefit” to the real estate world:

1. The Good Benefit is a Temporary Deferral of capital gains reinvested in OZ real estate (through an Opportunity Fund);

2. The Great Benefit is a Step-up in Basis for capital gains reinvested in OZ real estate and held for at least 5 years; and

3. The Off-the-Charts Benefit is Tax Free Gain associated with the increase in value of the OZ real estate following the initial investment.

Roll Over Gain

The Good Benefit of the OZ Program allows an investor to sell an appreciated asset, such as real estate or stock (anything that generates a capital gain) and then to defer tax on that gain by investing the gain in a Qualified Opportunity Fund (a “QOF”). More on QOFs later. The gain is deferred until sale of the interest in the QOF or until December 31, 2026, whichever comes first.

The Great Benefit of the OZ Program gives investors a 10% step-up in basis if they hold the investment for at least 5 years. Investors get another 5% step-up (for a total of 15%) if they hold the investment for at least 7 years. For example, if you sold stock in 2019 with a $100,000 capital gain and you reinvest that gain into a QOF, no tax is due on that gain until the sale of the QOF or until December 31, 2026. If the investor sells in 2020, tax is paid on the full $100,000 of gain. If, however, the investment is held for 5 years before sale, 10% of the gain becomes tax free. This is the Great Benefit. If the investment in the QOF is sold in 2026 (6 years after purchase) the investor pays tax on only $90,000 of the original $100,000 in gain. Because the program comes to an end less than 7 years from now, you are no longer able to maximize a new investment but had one invested in 2018 and if the QOF investment is held for at least 7 years, another 5% of the gain becomes tax free.

There are two time clocks ticking that may impact an investor’s ability to take advantage of the full step-up benefit. First, the 5-year/7-year clock starts ticking when the investment is made in the QOF. The second clock is the countdown to December 31, 2026. If you are checking the math, you will note that in order to take full advantage of the 15% step up in basis, you had to start the 7-year clock by the end of last year (2019) so that it can fully run before December 31, 2027. That means that a newly made investment can only get a 10% step-up in basis.

Although the maximum benefit has passed us by, there are still HUGE benefits available for investments made after that date. If you invest by December 31, 2021, you still get the 10% step-up. More importantly, you still have access to the Great Benefit.

Tax Free Gain

The Roll-over gain is recognized in 2026, no matter what. Even if the taxpayer dies. No step-up on roll-over gain (so different than 1031). We think the estate will preserve the 10-year deferral and will preserve the tax free gain on the OZ investment.

(Source: Colorado Office of Economic Development & International Trade)

Northern Colorado Opportunities

In Colorado, Opportunity Zones may help address a number of challenges:

1. Promoting economic vitality in parts of the state that have not shared in the general prosperity over the past few years;

2. Funding the development of workforce and affordable housing in areas with escalating prices and inventory shortages;

3. Funding new infrastructure to support population and economic growth;

4. Investing in startup businesses that have potential for rapid increases in scale and the ability to “export” outside the state of Colorado; AND

5. Upgrading the capability of existing underutilized assets through capital improvement investments.

(Source: Longmont Economic Development Partnership)

Several communities in Northern Colorado are positioned to accept OZone investment.

Broomfield, Lafayette, Boulder, Dacono and Longmont each contain significant opportunity zones and areas prime for development or redevelopment. The City of Boulder imposed a moratorium on development within its opportunity zone-blocking redevelopment temporarily. That moratorium was lifted in late 2019. Longmont’s opportunity zone also overlaps some areas with enterprise zone status, allowing for additional economic incentives to developing those locations. Further north, Loveland, Ft. Collins and Greeley are each ready for Ozone activity.

For more information on Opportunity Zones in Colorado, the Colorado Office of Economic Development & International Trade provides an excellent summary of the program as well as a directory of investment opportunities. Locally, the Longmont Economic Development Counsel can direct investors to opportunities in the city. As always, the attorneys at Lyons Gaddis are available to assist with your real estate and business investment and development questions. Please contact one of our Real Estate Attorneys to discuss your next deal.